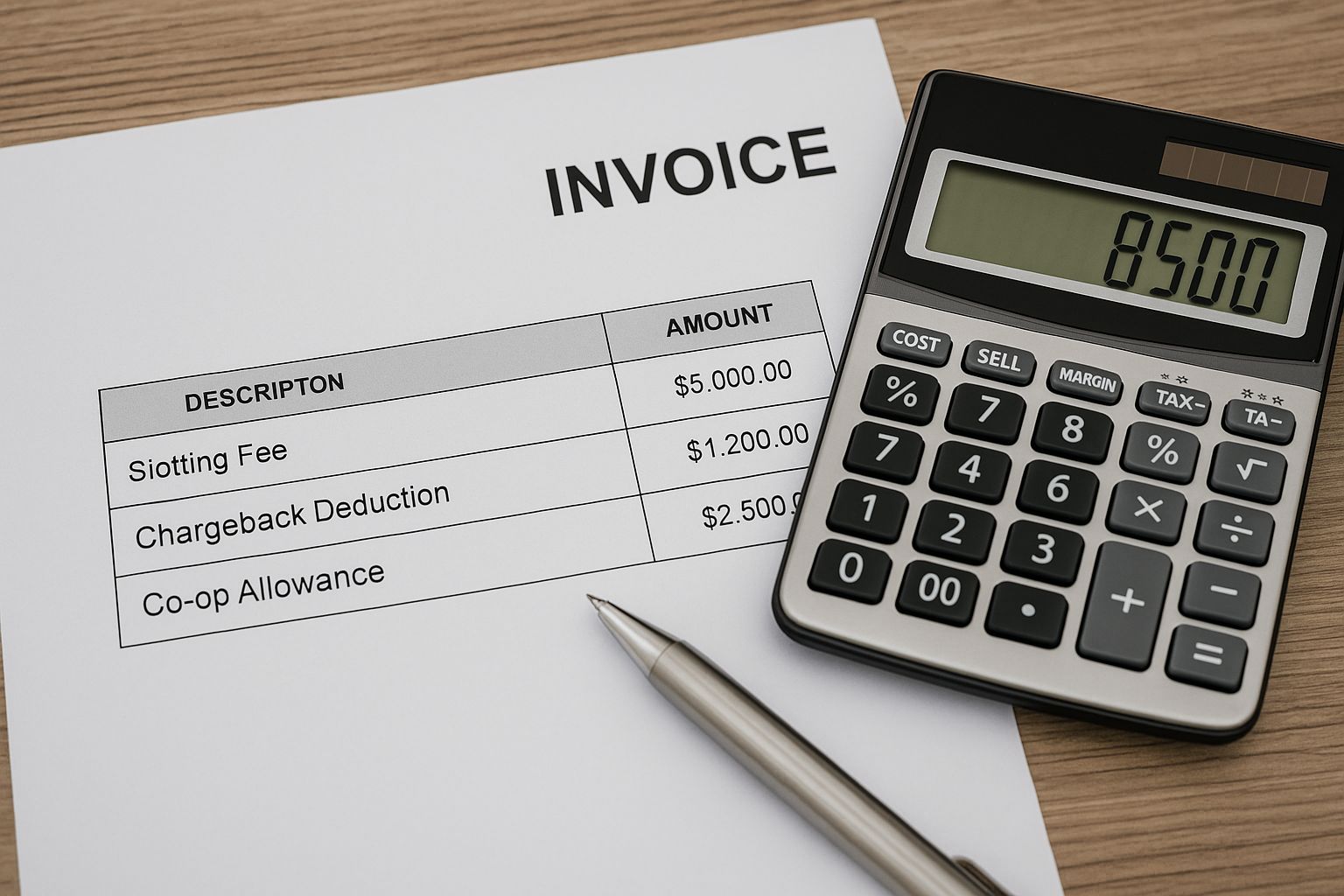

Understanding retailer costs begins with seeing where the money goes.

Slotting fees are upfront payments for shelf placement.Chargebacks are after-the-fact deductions when suppliers miss retailer requirements. Together with payment windows, allowances and promo obligations,these terms can quietly drain profit. Brands should budget for them, negotiate caps where possible, tighten EDI compliance, and dispute improper deductions with documentation.

• Slotting fees are one-time payments for initial shelf or warehouse access, typically charged when launching new items.¹

• Economists note slotting contracts arise from competition for promotional shelf space, not only from retailer power.²

• Chargebacks (deductions) are penalties for failing vendor rules, from labeling and data errors to delivery noncompliance.³

• Strong EDI discipline matters: invoices (EDI 810) must reconcile with POs (EDI 850) and ASNs to avoid deductions.⁴

• Retail compliance gaps are common; small errors can cascade into costly chargebacks without a dispute process.⁵

Slotting fees are upfront payments that help retailers offset the cost and risk of onboarding new SKUs. They also ration scarce shelf space toward products expected to move. In practice, the amount and structure vary by channel and category. High-traffic placements and multi-SKU entries typically cost more. For emerging brands, the cash impact can be significant,so model different volume scenarios before agreeing.

Paying for space is common; paying without a margin model is dangerous.

Chargebacks are retailer deductions applied after shipment or sale when supplier actions (or data) violate compliance rules, from carton labels to delivery windows. Typical triggers include incorrect UPC data, short or over shipments, ASN or invoice mismatches, missing promo materials, or OTIF issues. Reduce them by aligning item data, barcodes and pack specs with each retailer’s guide, and by reconciling PO, ASN and invoice data before billing.

Most chargebacks are preventable when your data and deliveries match the retailer’s rulebook.

Beyond slotting and chargebacks, cash flow is shaped by payment terms (Net 30–60+), co-op and marketing allowances, scan fees, and other deductions tied to promotions or actual movement. Agree on definitions and caps early, then budget a realistic deduction rate in your P&L.

Terms set the gravity of your cash flow — learn them before they learn you.

Come with data, not hope. Ask for fee phases, credits against performance, or caps on deductions. Define proof standards for any chargeback and align item data before the first PO. Operationally, use a single source of truth for specs, barcodes and EDI; then monitor deductions weekly,disputing improper ones within the allowed window.

Negotiation wins you terms once — operations win them every week.

Your job is not to avoid terms, it is to master them. Model the cost of access, fund data quality and compliance, and make disputes a routine discipline. If you need help, our team works with brands to negotiate,operationalize, and recover margin.

Ready to protect your margin? Contact our team to discuss your retailer terms and deduction strategy.

How to Win with Omnichannel Marketing

Retail Distribution Hidden Costs [+ Planning Checklist]

How to Craft a Brand Story That Wins You Shelf Space

Want to Land in Stores? Here’s What Buyers Expect

How to Evaluate Brokers, Distributors, and Sales Reps Before You Scale

1. The Food Institute, “The Evolving Economics of Slotting Fees in CPG,” 2024.

2. U.S. Department of Justice, Antitrust Division,“Competition and Platform Power in Consumer Goods,” 2024.

3. RVCF, “Chargebacks: Turning Challenge into Upside Opportunity,” January 8, 2024.

4. GS1 US, “EDI Recommendations for FSMA 204 Critical Tracking Events (ASN 856),” March 12, 2024.

5. RVCF, “2025 Retail Deduction & Compliance Benchmark Report,” 2025.